| 1230 Words | 5 Min Read |

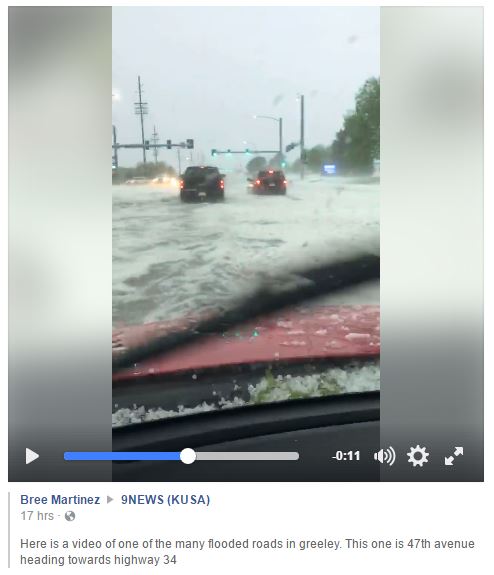

Wow! Who saw that coming? When you look outside your business or your home and you see this…

I wouldn’t be surprised if one of your first sinking thoughts are, “I hope I don’t have any damage!”

History of Hail in Colorado

Living in Northern Colorado, it is likely at some point you will need to file an insurance claim for hail damage, either for your car or for your home. On the Front Range, we are located in “Hail Alley.” This means we have the highest frequency of hailstorms in a year in the nation. In fact, Cheyenne, WY, just an hour drive from us, is the most prone city for hail, averaging 10 hailstorms per year.2

From 2005 - 2015, Colorado had over $3 billion of hail damage claims. This means that a up to half of your home insurance premiums may be covering hail and wind damage in Colorado.1

The largest hailstorm damage in Colorado history was back in July 2009 in the Denver Metro area. A record $767.6 million of damages was reported. But adjusting for inflation, the most costly hailstorm was in the Denver Metro area again in July 1990. At the time, over $625 million of damage was recorded. Adjusting for inflation, that is now over $1.1 billion of damage!1

The largest hailstone recorded was in 2010 in South Dakota. This hailstone was reportedly 8 inches in diameter and weighed 1.94 pounds. The hailstone is now preserved at the University of Colorado in Boulder.1

How Do I Know if I Have Hail Damage?

After a hailstorm, it is always important to check for damage on your property and your vehicle.

For Vehicles, damage can be easy to spot:

Dents on the body

Cracks or dings in the windshield

Body paint chipped or scratched

Worst Case Scenario: A window has shattered.

Property:

You may not want to get up on the roof after every hailstorm. A good indicator if your roof will have some damage is if you inspect the rest of the perimeter of the property.4

Look for asphalt granules coming out of your gutters and downspouts

Look for dents on your gutters and downspouts

Look for damage to siding or windows

Look for damage on air conditioning units

Look for damage to your decks or other wood surfaces

If you want to check your roof for damage, it is important to know what type of roof you have and how hail can damage these roofs. We took these hail damage indicators from Traveler’s Insurance3:

Asphalt and Composition Shingles Hail Damage:

Random damage with no discernible pattern.

Hail hits that are black in color.

Loss of granules, which may expose the roof felt.

Asphalt and/or mat that appears shiny.

Hail hits that are soft to the touch, like the bruise on an apple.

Wood Shingles Hail Damage:

Random damage with no discernible pattern.

A split in the shingle that is brown/orange in color.

A split in the shingle that has sharp corners and edges.

A split in the shingle that has little to no deterioration at the edges.

Impact marks or dents along the splits.

What Do I Do After A Hailstorm?

1) Assess the Damage

Check out the previous section to tell if you have damage.

Ask a reputable roofer or repair service to help you assess damage.

2) Protect From Further Damage

Cover broken windows on your house or your car.

Cover holes on the roof if water is leaking into the house.

Remove any compromised tree limbs that could cause more damage to your property if another wind or thunderstorm comes along.

3) Document Everything

Take pictures of all the damage you see.

4) File a Claim

Contact us or your insurance carrier if you have damage.

5) Select a Repair Company

Select a repair contractor or company before filing a claim to help advise you or after an insurance adjuster came out to access the damage.

Always select a reputable repair company. Make sure they have worker’s compensation and general liability. If they don't, you may be liable if a worker gets hurt on the job or causes damage to a neighbor’s house.

Don’t use a guy who is driving around your neighborhood with a ladder.

Don’t make any final payments until the new roof is installed and you are satisfied with the work.

Beware of scams from windshield replacement businesses.

6) Hold onto all Documentations

Hold onto all receipts and documentations to be reimbursed for the costs to replace roofs and fix other damage.

Frequently Asked Questions

It just hailed, should I contact my insurance agent?

You do not have to contact us after every single hailstorm. If you suspect damage, please do call. We will advise you on the best next steps. A good way to suspect damage to your roof is if the asphalt granules are coming out of your drainpipes. Or for peace of mind, give a reputable roofer or repair service a call to help you assess the damage. If you are unsure what to do after a hailstorm, don’t hesitate to give us a call. We will advise you on what you can do and if you may need to file a claim.

It just hailed, should I file a claim?

If it just hailed, inspect for damage. It is okay to file a claim right away, but many will check with a reputable roofer or repair company before filing a claim. They will advise you if you need to file a claim or if you should wait. If you file a claim for only very minimal damage or after every hailstorm, there is a potential of getting higher premiums upon renewal, this is why we suggest checking with a professional roofer first. Give us a call and we can advise you on best next steps.

When do I contact a repair company?

If you suspect damage and want peace of mind, it’s okay to get a second opinion from a reputable repair company before you file a claim. If you feel comfortable that you have damage, contact a repair company after your insurance adjuster has surveyed the damage.

Can I Wait to File a Claim?

First of all, make sure there is no longer a threat for more damage such as a leaking roof. A reputable roofer can help tell you if you have damage that needs to be taken care of immediately. If the hailstorm occurred at the beginning of the hail season (mid-April to mid-August) and the damage was minor, some people will wait until the end of the season. We do live in “Hail Alley” and there is likely to be more hailstorms causing more damage. But be aware, in some instances you can capture your recoverable depreciation when fixing your roof with the insurance company. Sometimes there is a time limit on when you can do that. If you have questions about filing a claim, give us a call and we will advise you on best next steps.

How Long Will It Take to Get My Property Fixed?

Often insurance carriers are fairly responsive after a major hailstorm and will send insurance adjusters from other regions to help with the demand. But also be aware, if you are filing a claim, so are many more people. Remember to always get repairs done from a reputable servicemen or company. They will also likely be busy with many repair jobs. Best advice: Be patient but it’s okay to check in with your insurance carriers and repair companies to make sure the process is moving along.5

Do I Contact You or My Insurance Carrier When I Need to File a Claim?

You can do either! You can go straight to the carrier first to file a claim or we can help you with the process. If you do go straight to the carrier to file a claim, still contact us about the process. We are here to advise you!

Can I Save Money After Getting Repairs Done?

Yes! If you replace your roof with hail resistant materials, you may be qualified for a hail resistance discount on your home insurance. Also, you may be able to capture your recoverable depreciation after a new roof is installed. That means another check for you!

Further Resources

1. Hail Statistics from RMIIA

2. Hail Alley Facts from KOCO Weather

3. Hail Damage on Roofs from Travelers

4. Assessing Hail Damage from Roofing Life

5. What to Do if You Have Hail Damage From 9News