What affects your auto insurance rates? Many factors! Last week we looked at location and which state has the highest and lowest auto insurance premiums. If you want cheap auto insurance, live in Maine. If you want expensive auto insurance, live in Michigan.

Today, let’s look at another factor that can greatly change your auto insurance rate: age and gender.

Age:

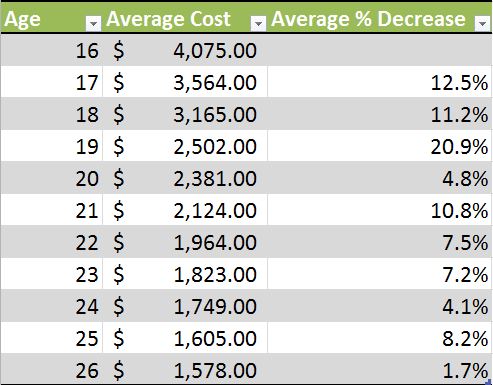

You probably have heard the younger you are, the higher the auto insurance premium you have. A younger driver tends to be less experienced and their auto insurance premiums will typically decrease every year with more driving experience. You may have heard the magic age is 25 to get to a place where your auto insurance premium will be more manageable.

When I turned 25, I was surprised to see that my auto insurance didn’t seem to drop drastically. How much does it drop when you turn 25? On average, only 8.2%! Which age range has the largest drop in auto insurance rates? From 18 to 19. The average drop in insurance is 20.9%!

Past the age of 25 though, your auto insurance rate keeps falling every year but at an insignificant rate. It will keep falling until you reach the age of 60, where it will start to increase again. A 75-year-old will pay 17% more than a 60-year-old!

Going back to looking at auto insurance by state, Hawaii and California do not factor age into their insurance rate calculations. But California will look at how many years you have been driving.

Gender:

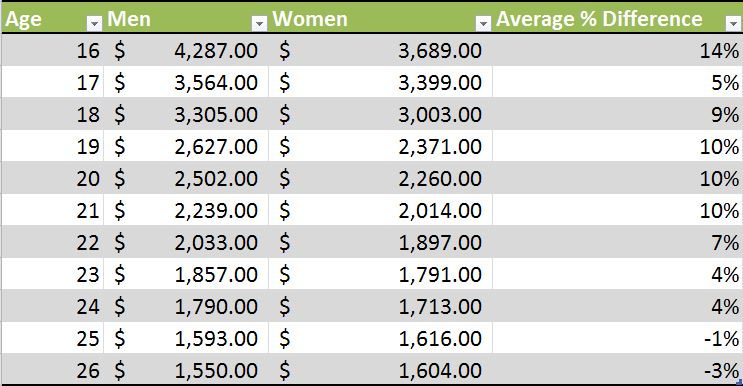

Gender does play a part in how much you pay for auto insurance, especially at the ages mentioned above. A young man under the age of 25 can expect to pay an average of 8% more than a young woman in auto insurance premiums.

That is until the age of 25, where women are starting to pay a higher premium on average. Surprising!

Massachusetts, Hawaii, and North Carolina do not factor gender in when calculating insurance rates!

Marriage:

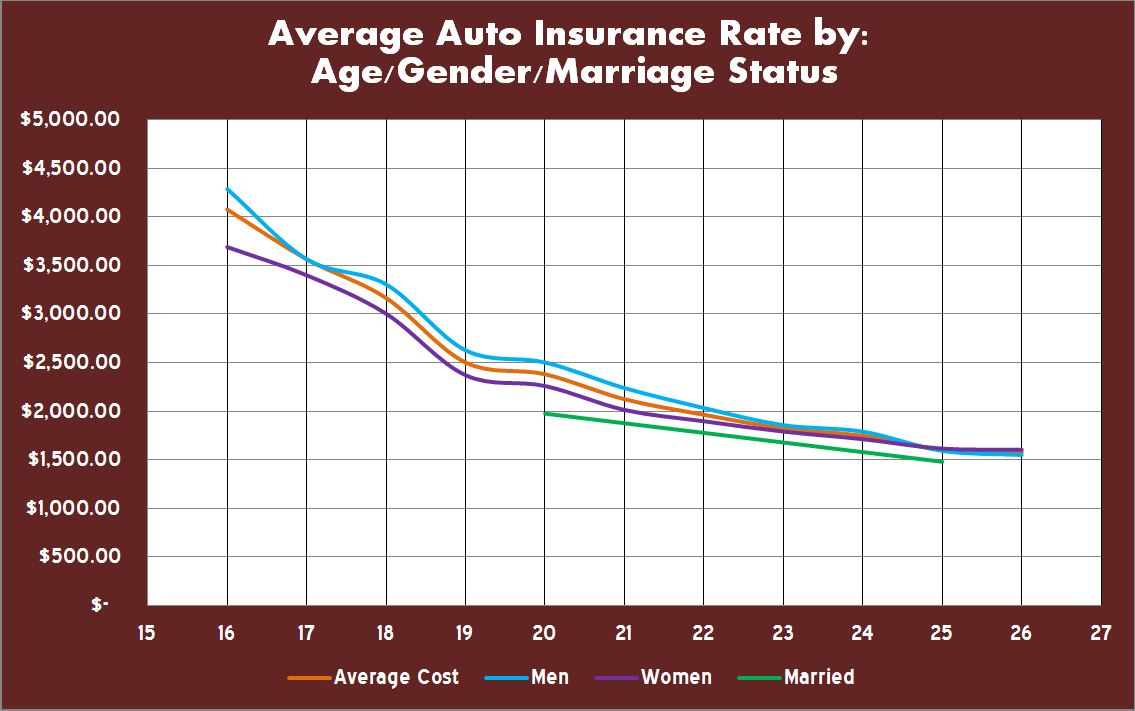

So guys, how can you reduce your auto insurance rate when your young? Become a Prince Charming a marry a young lady!

Young men who are married pays less than when they are single.

- At the age of 20, a young male will pay 21% less married than single.

- At the age of 25, a young male will pay 7% less married than single.

- At the age of 30, things start leveling off and a man will pay only 2% less than a married man.

Hawaii is the only state that does not calculate in marriage status into their insurance rate.

Here is a chart to show the average insurance rate by age, gender, and marital status for a young person. After the age of 25, prices start to level out among all categories.

So, with what we have looked at so far, what will make you have the highest auto insurance rate? Being a 16 year old, single male, in the state of Michigan!

Questions about your own auto insurance rate? Or wondering if you can get a cheaper auto insurance price?

Contact us for a free, no obligation quote, to help you answer questions about your policy, or to simply chat with us!

Sources:

http://www.huffingtonpost.com/laura-adams/how-age-gender-and-marital-status-affect-your-car-insurance_b_6973360.html

http://www.autoblog.com/2015/03/26/young-married-cheaper-car-insurance/

http://www.carinsurance.com/average-rates-by-age.aspx