If you have a child attending college in the fall, it is important to note there have been some changes to the FAFSA filing system.

Changes to the FAFSA Filing System

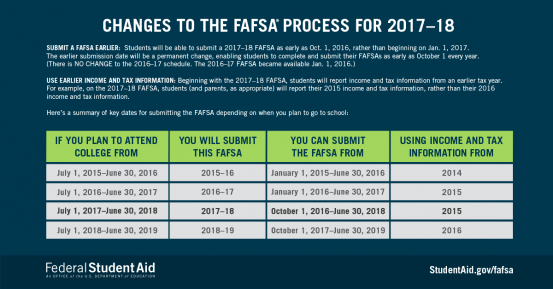

If you’ve had children that have gone to college in the past, the FAFSA process always opened Jan 1st of the year your student is attending school.

Starting this upcoming school year (2017-2018), and now every year following, the FAFSA process opens earlier, now October 1st. (For the 2017-2018 school year, the FAFSA open date was October 1st, 2016.)

Tips for Filing FAFSA with the New Filing Dates

- Always note the date schools require a FAFSA. Some schools will now state, “As soon as possible after Oct. 1st.”

- You don’t have to apply to every school you’re interested in before filing a FAFSA. On the FAFSA form, you can list the schools you have applied to and ones you might apply to.

- The taxes you report for FASFA is now the year BEFORE the FAFSA opening October 1st date. (So if your filing for the 2017-2018 school year, you must report 2015 taxes. 2018-2019 school year will report 2016 taxes.)

- If your income has dramatically changed since the reported tax year, still apply with that year’s information and then visit your schools’ financial aid office to discuss how your income has changed.

- If you or your parent has gotten married since the last tax season, both spouse’s income for that year WILL have to be reported when filing.

- If you or your parent has gotten a divorce since last tax season, one spouse’s income will have to be subtracted.

- Even though you might have a longer time frame to file, always file for FAFSA early! Some states distribute financial aid on a first-come-first-serve basis.

- Never leave any question blank, even if the answer is ZERO. 40% of FAFSA forms with mistakes are delayed!

For more information on the change, please visit The Federal Student Aid Website.