I am a twenty-something year old, a millennial you might say. I recently graduated with a business degree with honors in DEBT. I am currently climbing out of the dark pit of debt, realizing that I’ll be climbing for the next 7 years or so. Sounds exhausting. No wonder millennials are enamored when politicians talk about free college tuition. (Reality check: someone has to pay for it. It can't be free!)

But right now, we pay our own debt, and that is okay because it is part of life. The goal should always be working toward getting out of debt. At Union Colony Insurance, and as a Dave Ramsey Endorsed Local Provider, we believe working to be debt-free should be done sooner rather than later. The sooner you can pay that last payment, the sooner you have MORE money in YOUR pocket.

Often we talk about where we can save money in order to pay off debt. But how about the other end of the spectrum? How can you earn some extra money to start paying off your debt quicker?

Perhaps the first thought is, “I’ve been asking for a raise for years!” Well, instead of at your job, look of ways to earn extra cash outside of work. Where can you begin? How about your skills or passions!

Here are 6 ideas to start earning extra cash with the skills/passions you already have!

1) Dough for Dough

One friend from college, after graduating and getting married, found a passion for bread. Not eating bread, but baking! He used social media to advertise his passion to pick up some extra cash here and there. Start selling your bakes for a little bit of ‘dough!’ (See what I did there!?!)

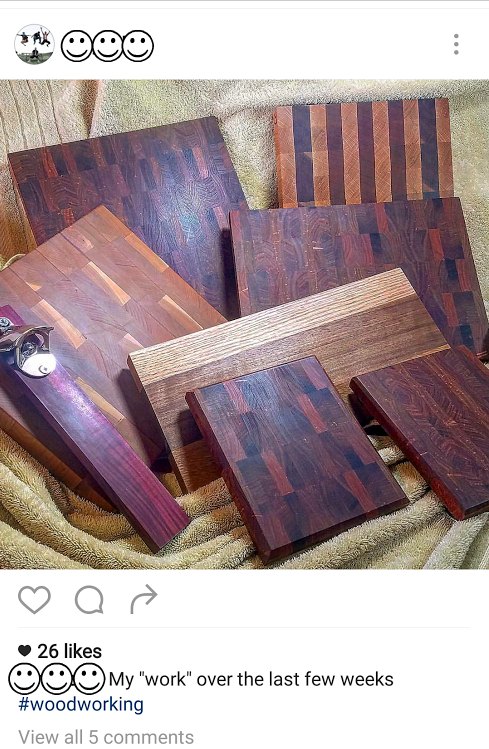

2) Knock on Wood

Sitting in a small garage in the middle of winter. There’s only a small floor heater for warmth. The smell of sawdust. Ripping down a piece of wood with electric tools. Remembering to not measure once, cut twice…

Woodworking is the passion of many people, men and women alike. Look at the wooden cutting boards another friend from college made for minor production.

3) Flip or Flop

We usually associate the word ‘flip’ with ‘houses’, or with ‘flop’. But flipping a house can come with great risk and potentially great loss. Imagine flipping on a smaller scale? What about a second hand piece of furniture at the thrift store. Clean it up, refurbish it, and sell it on eBay or Craigslist!

4) Be Crafty to Earn Money

Spend hours and hours on Pinterest? A regular customer at Jo-Ann’s or Hobby Lobby? Turn your love of sewing and crafting into a small Etsy business.

5) Passed Your Driving Test?

An increasingly common way to start earning some extra cash is to be an UBER or LYFT Driver. A student at AIMS Community College recently told me that a couple of her professors are UBER drivers. Even professors need a little extra cash!

But know the risks as well when it comes to being an UBER driver.

6) Can You Talk?

For some people, their first thought might be, “I don’t have any skills or hobbies!” But can you speak English? Turn your ability to talk into a tutoring session. Wherever you may live, look at the student demographics. Is there a university in your area? Public schools? Or a lot of young families? Become an English tutor or a babysitter!

Upload a tutor or babysitting profile to Care.com to be hired for tutoring/babysitting gigs. The average rate of a college tutor in Greeley is $12.50/hour.

The purpose of this article is to help you brainstorm of ideas where you can use your passion or skills to earn some few dollars to help you get out of debt. Be realistic. You are probably not going to start a self-sustaining business right away. The goal is simply for a few dollars more.